FREE MORTGAGE CALCULATOR IN EXCEL SPREADSHEET IN 2024

MORTGAGE

CALCULATOR IN EXCEL | Let's how to create a mortgage

calculator in excel 2023 to calculate our mortgage payment per month.

Intro -

In this blog post, we will show you how to use an Excel mortgage calculator to easily calculate your monthly payment.

IF YOU DO NOT KNOW WHAT IS THE MEANING OF MORTGAGE THEN I HAVE EXPLAINED IT IN THE LAST ARTICLE.

Follow

the simple steps outlined in this blog post and you will be able to calculate

your mortgage payment in no time!

This

Excel worksheet makes it simple to see the amortization of a house loan with

extra monthly installments. Do you want more features? View interactive graphs

for your loan on our website.

You may

use our website to discuss computations, view local mortgage rates, and

generate printable loan amortization charts.

On our

website, you may also include other charges such as property taxes,

homeowners' insurance, and HOA fees.

If you

are searching for how to build a mortgage calculator in excel so, stop now I

have shared an advanced Excel sheet for you.

WHAT IS MORTGAGE CALCULATION IN EXCEL SPREADSHEET?

A

mortgage calculation in excel spreadsheet is a tool that allows you to quickly

and easily calculate your monthly mortgage payment.

The MS

Excel mortgage payment calculator will input your monthly mortgage amount,

interest rate, and term of the loan.

The Excel calculator will then output a

monthly mortgage payment that you can use to track your progress over time.

HOW TO CALCULATE YOUR MORTGAGE IN EXCEL - THE QUICK AND EASY WAY

Our

lives are always hectic and full of errands, so it's hard to squeeze in time to

calculate your mortgage. But don't worry! This blog will show you how to use

a mortgage calculator in excel easily and quickly. All you need is your

home loan amount, interest rate, and mortgage term.

Then,

follow the simple instructions and you'll be on your way to getting your

mortgage amount in excel format. So what are you waiting for? Go ahead and try

out this MS Excel mortgage calculator now!

HOW TO USE A MORTGAGE CALCULATOR IN EXCEL SPREADSHEET?

To use

the mortgage calculator in an excel spreadsheet, first identify your loan's

interest rate and term.

Next,

input your monthly mortgage amount into the cell below. The calculator will

then calculate your monthly payment using this amount and interest rate.

Finally,

print out a copy of the results so that you can track your progress over time.

TYPES OF MORTGAGE CALCULATION IN EXCEL SPREADSHEET?

The mortgage

calculator in an excel spreadsheet can be used to calculate both

amortization and principal payments.

STEPS OF MORTGAGE CALCULATION USING EXCEL SPREADSHEET?

1)

Start by inputting your loan information into the worksheet. This includes your

monthly mortgage amount, interest rate, and term of the loan.

2)

Next, use the calculator to calculate your monthly payment based on this

information. The payment will be displayed in a column on the left-hand side of

the spreadsheet.

3)

Scroll down to see how much money you'll have paid off after amortization and

principal payments are applied each month!

MORTGAGE AMORTIZATION SCHEDULE IN EXCEL SPREADSHEET?

The

mortgage calculator in an excel spreadsheet can also be used to calculate

amortization payments.

This

schedule shows you how much money you'll pay down on your loan each month. The

table will include the amount of principal and interest that is paid during

each month, as well as the total amount that's being paid down over the term of

the loan.

ADVANCED SMART MORTGAGE CALCULATOR

HOW TO CALCULATE THE INTEREST RATE ON A MORTGAGE WITH EXCEL SPREADSHEET?

The

mortgage calculator in a Microsoft Excel spreadsheet can

be used to find your loan's interest rate. This number is used to calculate the

monthly payment on your loan.

To do this, enter the interest rate and term

of the loan into the worksheet cells below.

The

calculator will then display a column that lists your monthly payment amount in

dollars and cents.

TIPS

FOR MAKING A MORTGAGE PAYMENT CALCULATIONS WITH EXCEL SPREADSHEET?

1) Use

the mortgage calculator in Excel to find your loan's interest rate. This number

is used to calculate the monthly payment on your loan.

2) Be

sure to input all of the required information into the worksheet cells below -

this includes your loan amount, interest rate, and term of the loan.

3) The amortization

schedule will also be displayed in a column on the left-hand side of your

spreadsheet. This table shows you how much money you'll pay down on your loan

each month.

4)

Scroll down to see how much money you'll have paid off after the term of your

loan is completed. This information will be displayed in terms of the total amount

paid down and the remaining balance on the mortgage.

IF YOU WANT TO USE A MORTGAGE CALCULATOR THEN USE IT FOR FREE.

CALCULATING PREPAYMENT PENALTY ON MORTGAGE WITH EXCEL SPREADSHEET?

When

you decide to prepay your mortgage, there may be a prepayment penalty

associated with it.

This

penalty is calculated as a percentage of the amount of prepayment and can add

up over time. To calculate this penalty, enter the loan's interest rate and term

into the mortgage calculator in an excel spreadsheet.

The

calculator will then display a column that lists your monthly payment amount in

dollars and cents, as well as the total amount of pre-payment penalties paid so

far during the term of your loan.

HOW TO USE THE MORTGAGE CALCULATOR IN EXCEL?

To use

the excel mortgage calculator, first, open the file and enter all of your

necessary information.

The

program will then calculate your monthly payments and provide a summary of the

results. If you have any questions or need further help, consult the

instructions provided within the spreadsheet.

Mortgage

calculators are an essential tool for home buyers, so make sure to have one at

your disposal!

WHAT IS THE BEST WAY TO CALCULATE MY MORTGAGE IN EXCEL?

If

you're looking to calculate your mortgage in Excel, start by gathering all the

necessary data. This includes your down payment, estimated monthly payments

(including principal and interest), the total amount of tenure, amortization

schedule, and so on.

After

you have this information ready, it's time to get started on the calculations!

The first step is to enter in your loan particulars into a worksheet - like

Interest Rate (%), Term (years), Principal & Interest Payment (each month), and Down Payment Amt. From here, it's just a matter of doing the math and

solving the equations!

WHAT ARE SOME TIPS FOR FORMATTING AND SAVING YOUR SPREADSHEET PROPERLY

There

are a few tips that you can follow to ensure that your spreadsheet remains

properly formatted and easy to read. First and foremost, always save your

spreadsheet as PDF or XLSX files for easier viewing on a computer or tablet.

This

will make it easier for you to understand and work with the data within the

spreadsheet. Second, always make sure to use the correct format for your data.

This will ensure that your spreadsheet is easy to read and understand.

For

example, if you're organizing your data in rows and columns, make sure to use

the appropriate number of columns and rows. Finally, you should also save your

spreadsheet in a specific file format, so that you can easily access it when

you need it.

For

example, if you're working on a project that requires access to your

spreadsheet periodically, saving it in a cloud-based service like Google Drive

or Dropbox can be ideal.

Assessing

monthly loan payments with an Excel spreadsheet? You can use an excel spreadsheet

to calculate monthly loan payments. Begin by entering the following information

into your worksheet:

-Your

loan amount (in dollars)

-The interest

rate you're paying on your mortgage (either as a decimal or as a percentage)

-The

number of months in the term of your mortgage

-Your

monthly mortgage payment (in dollars)

Once

you have this information, you can begin to calculate your monthly loan

payment. To start off, enter the following formula into cell B2 of your

worksheet:

WHAT IS THE FORMULA FOR THE MORTGAGE CALCULATOR IN MS EXCEL?

There

is no one-size-fits-all mortgage calculator formula, but generally speaking a

mortgage calculation in Excel can be done by using the following formulas:

Mortgage

interest rate = loan amount x interest rate%

Principal

payment = loan amount - interest payments

The

above formulas can be rearranged to produce a mortgage payment schedule, which

is helpful in planning monthly budgeting:

Mortgage

payment = [Principal amount] x [Interest rate (%)]

The

"loan amount" and interest rates mentioned in the mortgage

calculation formula are typically found on loan application forms or online

calculators.

=PAYMENT+INTEREST*(MONTHLY MORTGAGE PAYMENT/12)

WHAT IS

THE FEATURE OF MORTGAGE MS EXCEL SHEET

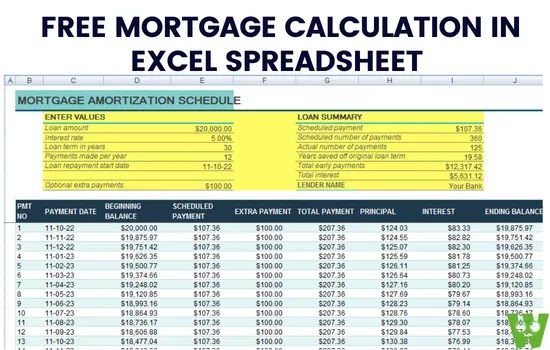

VALUES -

Loan

amount.

Interest

rate.

Loan

term in years.

Payments

made per year.

Loan

repayment start date.

Optional

extra payments.

LOAN

SUMMARY -

Scheduled

payment.

Scheduled

number of payments.

The actual number of payments.

Years

saved off the original loan term.

Total

early payments.

Total

interest.

The result will be shown in this format -

Scheduled

payment.

Extra

payment.

Total

payment.

Principal

interest.

Ending

balance.

Cumulative

interest.

LOAN

AMOUNT - the amount borrowed, or the home's worth after your down

payment.

The

specified APR of the loan is the interest rate. We post local Los Angeles

mortgage rates below for your convenience to let you see currently available

rates.

LOAN

LENGTH IN YEARS - The majority of fixed-rate house loans in the

United States are amortized over 30

years. Other popular domestic loan terms are 10, 15, and 20 years.

Loans

in certain foreign nations, such as Canada or the United Kingdom, are amortized

over 25, 35, or even 40 years.

PAYMENTS

PER YEAR - is set to 12 by default to compute the monthly loan

payment that will be amortized over the given number of years. If you want to

pay twice a month, enter 24, and if you want to pay once a week, enter 26.

LOAN

START DATE - the day on which loan repayments begin, which is usually

one month to the day after the loan was established.

If you

want to add an extra amount to each monthly payment, enter that amount here and

your loan will amortize faster.

If you

make an additional payment, the calculator will calculate how many payments you

saved off the initial loan period and how many years you saved.

If you want to learn about the navy federal auto loans calculator then I have written a complete detail on this site.

Conclusion -

Here I have shared one of the best free mortgage calculations in an excel spreadsheet in 2023 for beginners who want to calculate their mortgage amount by using M.S Excel. This is the most popular worksheet to choose for mortgage calculation.